When you're first starting out with budgeting it can get pretty overwhelming pretty quickly!

You can read this blog over here that says you need ten bank accounts + then read that blog over there that says you only need to use the cash system. So...now you're just stuck sitting there with your one or two bank accounts super confused + just wanting some real answers already! Geez!

That's why I'm so excited to share with you how I organize my bank accounts, what has worked best for my family as we work through paying off our $490k worth of debt, + give you some real life examples that you can actually use to help you get started organizing your own bank accounts today.

Hit play to watch the video version of this blog!

Side Tip for Success:

Cash System vs. Debit Card System

What I'm sharing with you today is what I personally use, which is the Debit Card System. However, the techniques that I'll be showing you can be applied to the Cash System also. The Cash System vs. the Debit Card System is not so much about the organization of your money as it is about where you physically store your money. So you can still organize your money the exact same way regardless of which system you prefer to use. Remember to take that into consideration as you read throughout this article!

my bank accounts

1. Bills Account (w/ debit card + checks)

2. Spending Account (w/ debit card)

3. Savings Account

4. Cash Savings (Just a little bit of cash stored at home for convenience.)

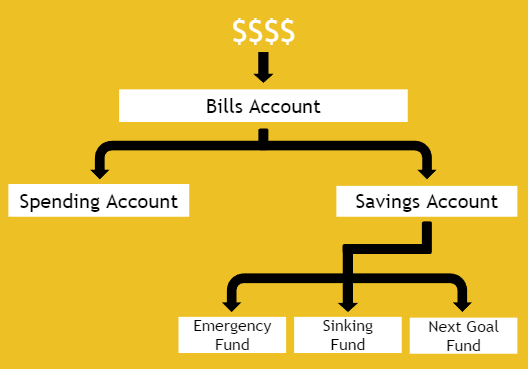

My bank account flow chart

flow of money

- Paycheck is deposited straight into our Bills Account

- Leave just enough to pay that pay period's bills + $10 buffer

- Transfer over only our spending allowance to our Spending Account

- Whatever is leftover goes straight into our Savings Account

- Then our Savings Account is broken down into our Emergency Fund, Sinking Fund, + our Next Goal Fund

NEED SOME help getting organized?

Check out my set of 14 Budgeting Worksheets that have helped families all over the world get their budgets organized!

Breakdown of Accounts

1. Bills Account

The first, and most important bank account is the Bills Account. So this is where I start on payday. Our money goes straight into the Bills Account (we do direct deposit, but manually depositing works just as well). I start with the money in this account because I think it's most important to make sure all of your bills are paid before you do anything else. Bills need to paid first because you can always scrimp on groceries a little, not pay extra towards your debt, or just not save anything extra...but you've got to have your bills paid! I feel like that should really be first priority in every budget. (This is all assuming you have enough for basic food needs of course.)

Included in this account: House Payment or Rent, Electricity, Water, Phone, Internet, TV, Monthly Memberships (Gym, Netflix, Audible), Car Payment, Credit Card Payment, Minimum Debt Payments, etc.

I add up exactly, to the penny, how much I need to pay all of the bills due within this pay period. I leave exactly enough in this account plus a $10 buffer. I do the $10 buffer just because I hate seeing my bank account at $0 after all of the bills come out, it's easy math, + it's small enough that I'm not going to miss it in the grand scheme of our goals.

Once I leave just enough to pay the bills + $10....that's all that's allowed to stay in that account! Then I transfer only my spending allowance for the pay period into the Spending Account + anything leftover gets transferred into the Savings Account.

The thing I love about this account is that it gives me that reassurance that our bills are paid no matter what! I know that the money can safely sit in that account until the payments clear, and I don't ever have to wonder about what is still pending or what has already cleared.

2. Spending Account

Next, after I've made sure all of my bills are paid, I transfer only my allowed spending amount for the current pay period over to my Spending Account. (Of course if you do the Cash System you can physically withdraw the cash from the bank + break it down into your envelopes...same organization of money still happening.)

Included in this account: Groceries, Gas (fuel for your car), extras, clothing, date night, fun money, eating out, etc.

I transfer only into this account what I'm allowed to spend until the next payday...when it's gone, it's gone! Then make a plan for that money. Say for example, it's $500. I'd ask myself... How exactly are you going to spend that $500? How much is going to go to groceries? How much is going to go to gas, your fun money, etc.? Then I plan it out on my budgeting worksheet.

Be realistic when you do this. Realize that if you're only allowing yourself $100 for a family of 5 for a whole month that it probably isn't going to cut it. So be realistic to your real needs!

...but also challenge yourself! Remember that you have goals that you're trying to accomplish + you don't want to just wildly spend all of your money. You want to make sure that you're having money leftover to apply to your debt or to throw into savings.

I leave all of my spending money together in this one bank account + just break it down into categories even farther on one of my worksheets; telling myself how I'm allowed to spend in each actual category (groceries, gas, clothes, date night, fun money, etc.) until the money is all spoken for.

If you're doing the Cash System you can do one big envelope for your Spending Account or you could take it a step farther and have separate envelopes for each category (groceries, gas, clothes, date night, fun money, etc). I've even heard of debit card people going that extra step farther and having separate accounts for a few of the different categories. Find out what way works best for you + go with it! Don't be afraid to test out a few different styles here.

The thing I love about this account is that I know for sure what I'm allowed to spend until the next payday. Even if it's a low amount...I can know for sure that things will be tight for the next few days, I don't have to wonder or guess. Or if my spending allowance is high, I know exactly how much fun I'm allowed to have. I also don't have to wonder if I'm going to accidentally spend the bills money at the grocery store! This allows me to spend in every category guilt-free!

READY TO GET INTENTIONAL

WITH YOUR SPENDING?

Break free from living paycheck-to-paycheck

...an abundant life is waiting for you!

3. Savings Account

We just have one Savings Account that we break down even farther on a worksheet. On one of my worksheets I say how much money is allotted for each category within this account: emergency fund, sinking fun, + next goal fund.

Included in this account: Emergency Fund, Sinking Fund, + Next Goal Fund

(I'll break all of these down more in a minute.)

Again, feel free to do all of these accounts with the Cash System or with separate multiple Savings Accounts...whatever seems to work best for your family.

Side Tip for Success:

Pay your bills first, then allow a realistic/challenged amount for spending, then any + everything leftover gets put straight into savings (or paid towards debt depending on where you are with your journey). This means don't wait until a week or two into the pay period to put money into your savings account....do it on payday!

I know that sometimes people will say that they don't have anything leftover to put into savings...well this is where you want to challenge yourself. Work backwards + ask yourself where you can lower your spending or cut back your bills.

Related Article: How to Create Wiggle Room in Your Budget

Looking for a simple approach

to your family's budget?

If you're wanting to overcome the overwhelm of setting up a family budget, reaching your money goals, + getting serious about your financial future, this guide will help you break free from the chaos.

Your Sunny Money Method is exactly what you need.

Savings Account Categories

1. Emergency Fund

This Emergency Fund is just to act as a buffer between you + resorting to using credit cards or other forms of debt in case of an emergency...which will unfortunately come up eventually, that's just how life works! So this will fund have you prepared!

First of all, before you payoff your debt you're going to just want a small Beginner Emergency Fund of about $500-$1,000. The amount depends on your income level, if you're a dual income family or not, etc...whatever feels like a comfortable amount.

Then, after all of your debt (except your home) is paid off you're going to want to bump up to the Larger Emergency Fund of about 3-6 months worth of expenses.

2. Sinking Fund

A sinking fund is something that a lot of people over-look in their savings. They completely skip this part and they let things that are non-regular expenses sneak up on them + totally ruin their budgets...and I don't want that to happen to you!

Included in this account:

- Holidays + Birthdays

- Vacations

- Home + Vehicle Maintenance

- Annual Registrations or Licenses (Could be vehicle or job related)

- Clothes (Seasonal groups of new clothes)

- Taxes (Income, Property, etc)

- Irregular Bills (Quarterly or Annually)

Don't worry if you can't sit down + name all of these Sinking Fund items off of the top of your head...if you tried to you'd probably miss one or two or more! I definitely couldn't remember all of them my first year of budgeting either. So what I did was I kept a running list as the year went on and one of those unexpected/unbudgeted-for expenses came up. We just started with Christmas + Birthdays and the list grew from there.

Don't really stress over this, just simply keep a running list! As something comes up that you wish you would have had money set aside for, add it to your list...it's that simple. It won't be perfect your first year, but you're second year I bet you'll be really on top of it!

Then what you'll want to do is add up the whole year worth of Sinking Fund expenses and divide it by how often you want to contribute to it. Simply add to the fund little by little...maybe every paycheck, maybe every month, whatever makes sense for you. The main goal here is to be contributing to it throughout the year so those expenses don't sneak up on you + totally ruin a good budgeting month.

3. Next Goal Fund

This is the fun part of the Savings Account! This is where you want to consult your goals list + actually start saving for things! Of course if these are non-needed things you'll want to wait to buy anything too crazy until after your debt is paid off + you have an established emergency fund saved. However, say your car is on it's last leg, and it's totally a need, this is how you save up to pay cash for those large ticket items...you actually take steps to do it! Maybe you need to set up a separate Savings Account at the bank or a separate cash envelope to hold yourself accountable...figure out what works best for you!

This is where you really put the pen to the paper + make those goals come to life!

Side Tip for Success:

If you don't already have a goals list...I want to encourage you to make one! Write out your goals with a money amount next it to. Figure out when you want to accomplish that goal + do the math to figure out how much you'll need to contribute from each pay period to make that happen. ...and then start contributing to that Next Goal Fund to actually make it happen!

This is how real people save up + pay cash for large ticket items...they write it on their goals sheet + have a place for it in their Savings Account. That's exactly how we did it + I want to encourage you to do the same thing!

Quick Money flow re-cap

- Paycheck is deposited straight into our Bills Account

- Leave just enough to pay that pay period's bills + $10 buffer

- Transfer over only our spending allowance to our Spending Account

- Whatever is leftover goes straight into our Savings Account

- Then our Savings Account is broken down into our Emergency Fund, Sinking Fund, + our Next Goal Fund

The key here, like I always say, is to really do what feels right for your specific family. I hope that this article helped you get a better idea about how I organize my bank accounts, + I hope that it inspired you to figure out how to organize your own bank accounts (or your Cash System) in a way that will work great for your family! Keep up the hard work friend! I'm always rooting for your success!

HEY I'M SAMI WOMACK

I'm the wife to my high school sweetheart, Daniel, + homeschooling momma to our 3 girls. I'm the Budgeting Coach + Motivational Speaker behind

A Sunny Side Up Life.

My family used to be in $490k of debt + living paycheck-to-paycheck, but after we hit rock bottom everything changed for us!

Now that my family has become debt free + gained financial freedom, I want to help your family do the same! My passion is inspiring women to live abundant lives through budgeting, intentional living, and positive thinking.

I offer a jump start into budgeting with my free 5-day email course + a full budgeting experience with my course, Your Sunny Money Method.