by Guest Author: Vee Weir from VeeFrugalFox

MDD, or Major Depressive Disorder, affects 16.1 million adults in the United States - or about 6.7% of the population. I was diagnosed with MDD and GAD (Generalized Anxiety Disorder) at the age of 16. Since then, I have battled my way through the jacked-up healthcare system, therapy, medication, and suicide. Throw college, a crappy divorce, and sick family members into the mix, and you have one interesting decade of experience.

While I know the topic of mental health is difficult for some to mull over, I think it's important to recognize that while on this debt free journey, you may struggle with a depressive dip - or experience anxiety surrounding money. This road is not easy, and your brain may try to sabotage your financial goals and dreams.

Here are 5 tips to survive getting out of debt when dealing with depression:

1. One day at a time

It's easy to get bogged down in looking at your entire mountain of debt all at once. You see a big number and think to yourself, 'What's the point?' That's why breaking up debt and taking it 'slowly, but surely' is imperative, especially to those who struggle to shower or get out of bed sometimes. One step at a time - one goal at a time. Paying off $100 and rewarding yourself for a job well done is way more digestible than looking at a six figure number.

2. It's Okay If You're Not 100%

When I went through my depressive episodes on my debt free journey, I would feel so guilty for spending any amount of money outside of my budget. I'd go down Pity Party Lane for not putting a certain amount towards debt each month. Then I'd think, 'Oh my God. I'm such a faker... posting on Insta that I'm living this life, when I'm really not.' The reality is that everyone messes up, and it's not even messing up, because its YOUR journey. YOU define it. As long as you're making progress, it's okay!

3. Find a Community

Depression and paying off debt can be isolating experiences. Both are seen as weird, and both are stigmatized in our society. Finding a like-minded community was what inspired me to keep moving forward. Without the debt free community on Instagram, I would have given up a long time ago. Whether it's a significant other, best friend, or an online fam - find a community that supports your vision. It makes a WORLD of difference. I have people everyday reach out to me about debt payoff AND mental health. How amazing is that!?

4. Ask for Help

For us stubborn mules, asking for help can be akin to deciphering advanced chemical engineering textbooks. It's difficult, and most times, it doesn't happen. I'm telling you from experience though, it makes healing much easier when you ask for help when you need it. It's not weak. It's not attention-seeking. EVERYONE needs help sometimes. Don't feel shame when reaching out for something. Need budget advice? Need help running errands? Need a shoulder to cry on? Don't have the energy to cook something every night this week? Call a friend, family member, or someone you can trust. No matter what 'help' looks like on your end, asking for it is essential on the path to a positive financial and mental health state!

5. Save, Save, Save

My emergency fund put my anxiety at ease in ways I can't explain. What made it even better was that I promised myself I'd put at least $20 a month towards it. $20 is nothing in the grand scheme of things, but it meant I was covering my butt and taking care of myself. Self care looks like bubble baths and expensive manicures on social media, but it's also providing for yourself in other ways, like an EF. I recommend always saving no matter what step of the process you're in. You'll definitely thank yourself one day - I know I did!

If you'd like to read this blog later, please save it to Pinterest.

Listen to the Podcast...

READY TO GAIN FINANCIAL FREEDOM

+ BREAK FREE FROM SURVIVAL MODE?

I'VE GOT EVERYTHING YOU NEED!

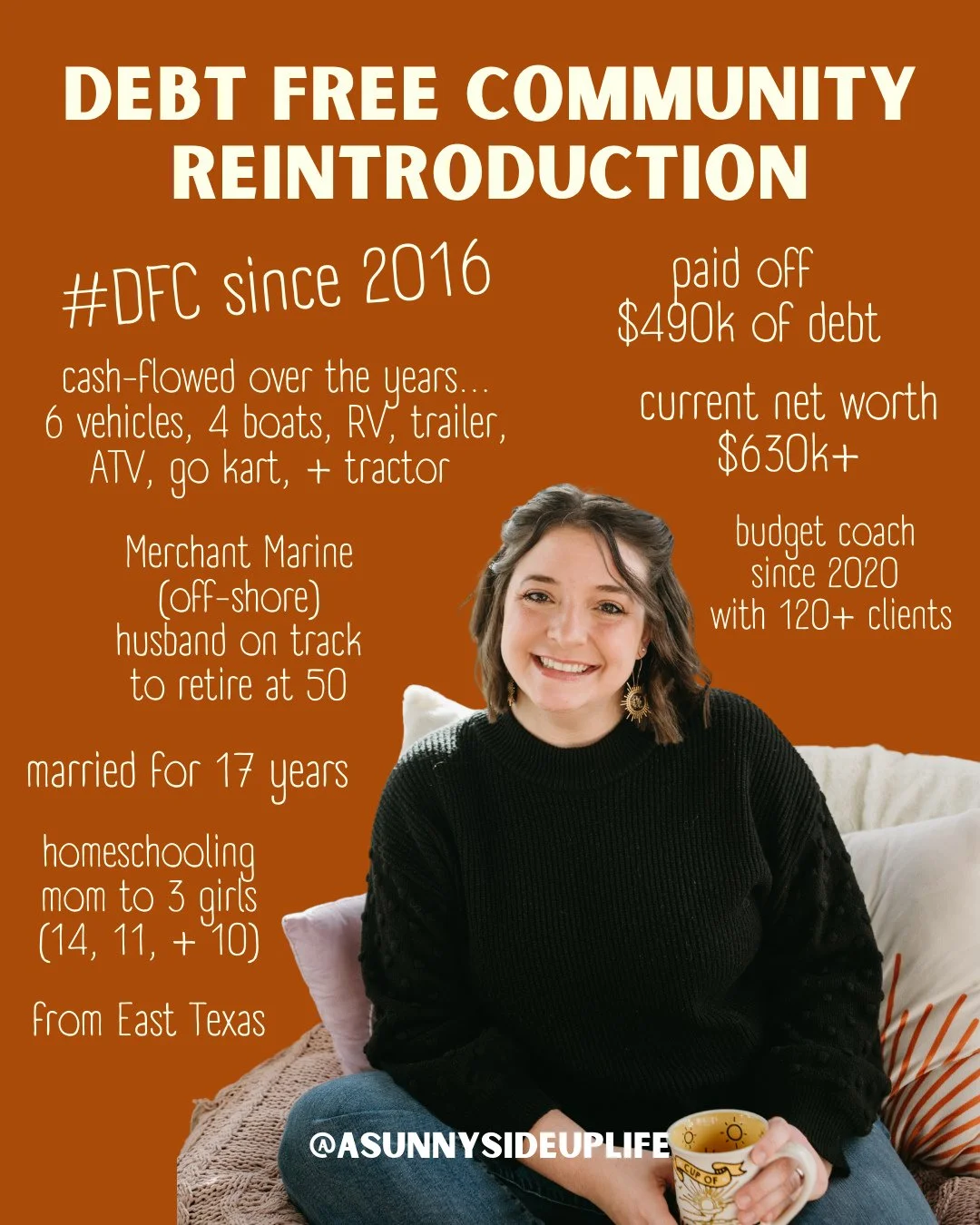

HEY I'M SAMI WOMACK

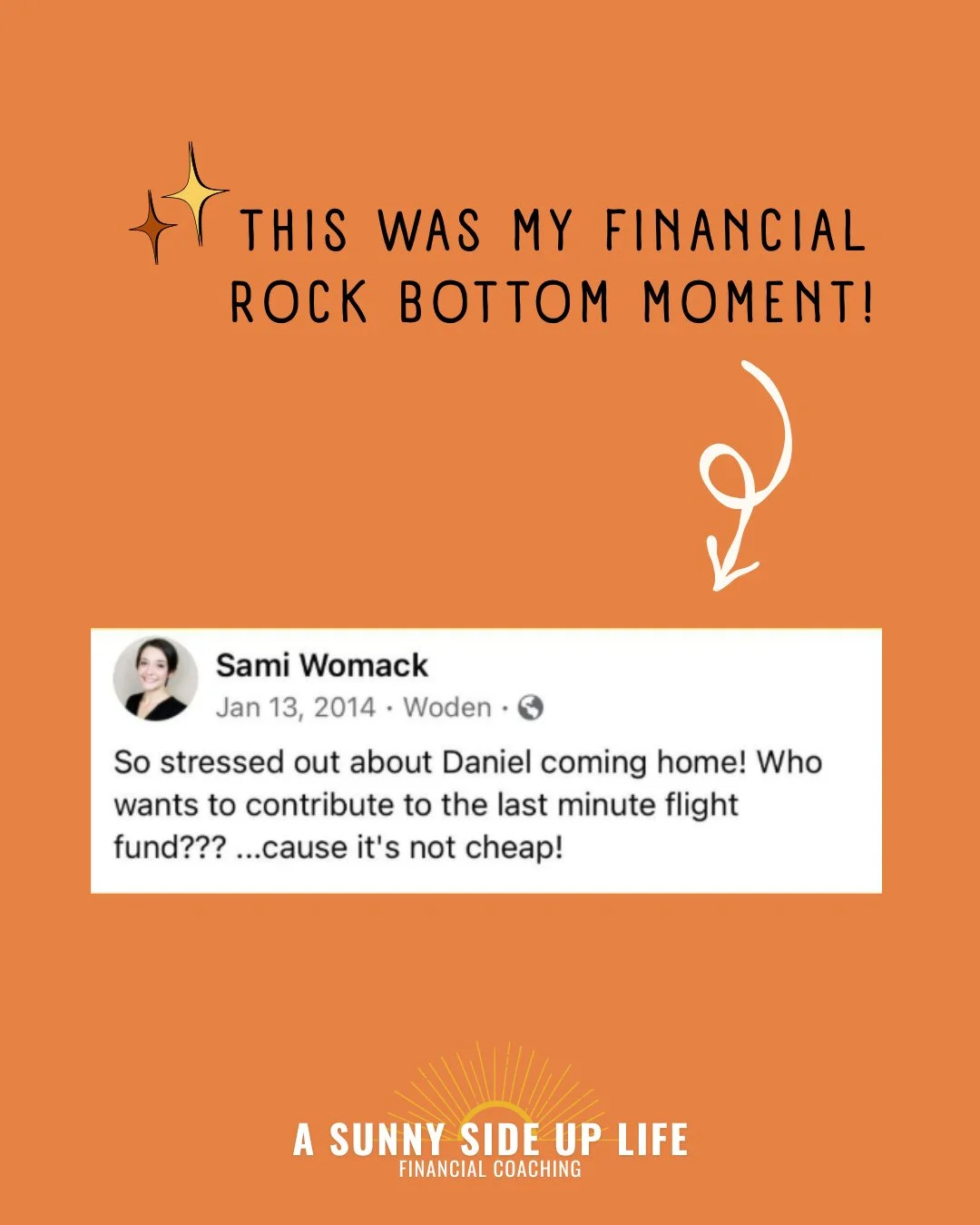

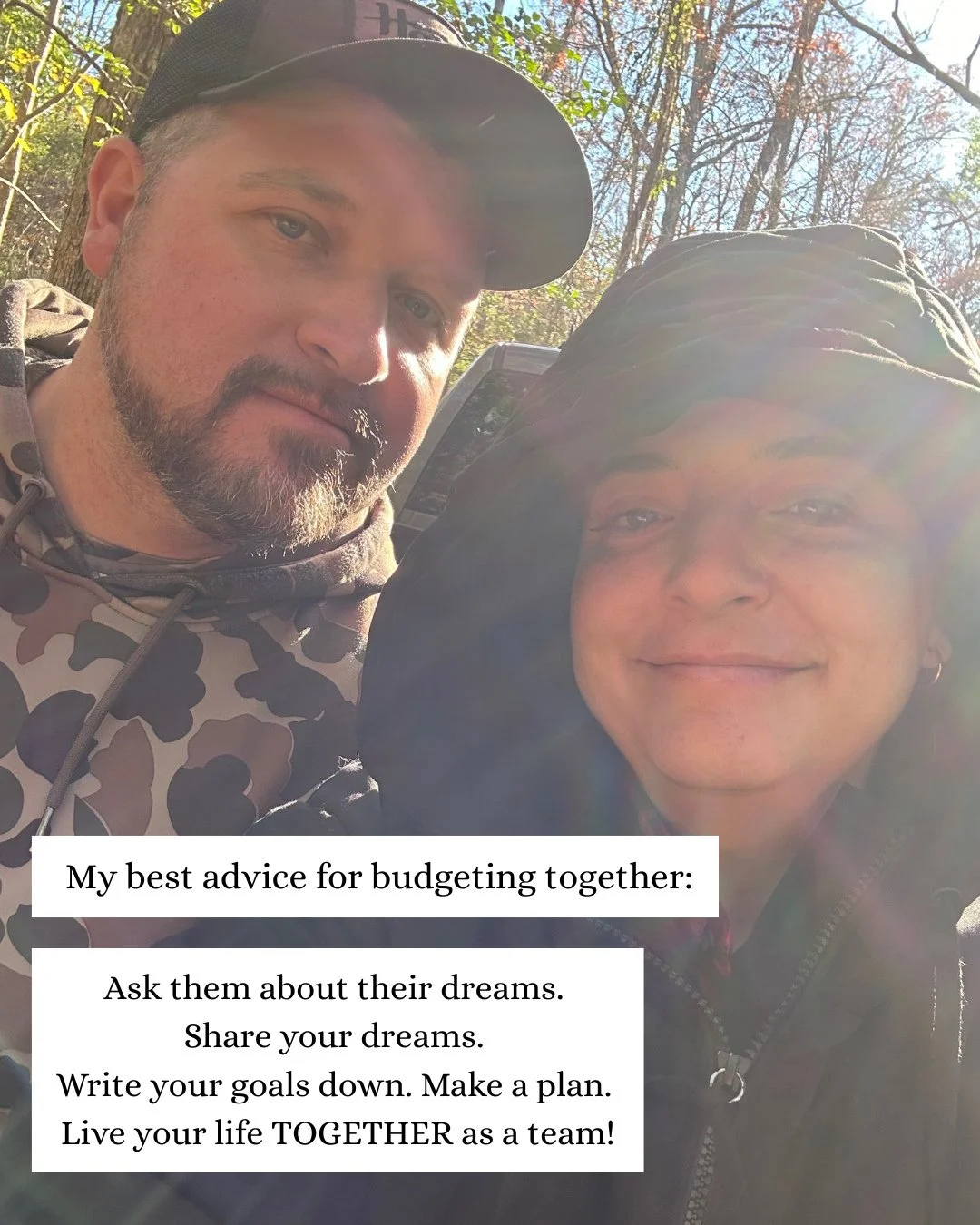

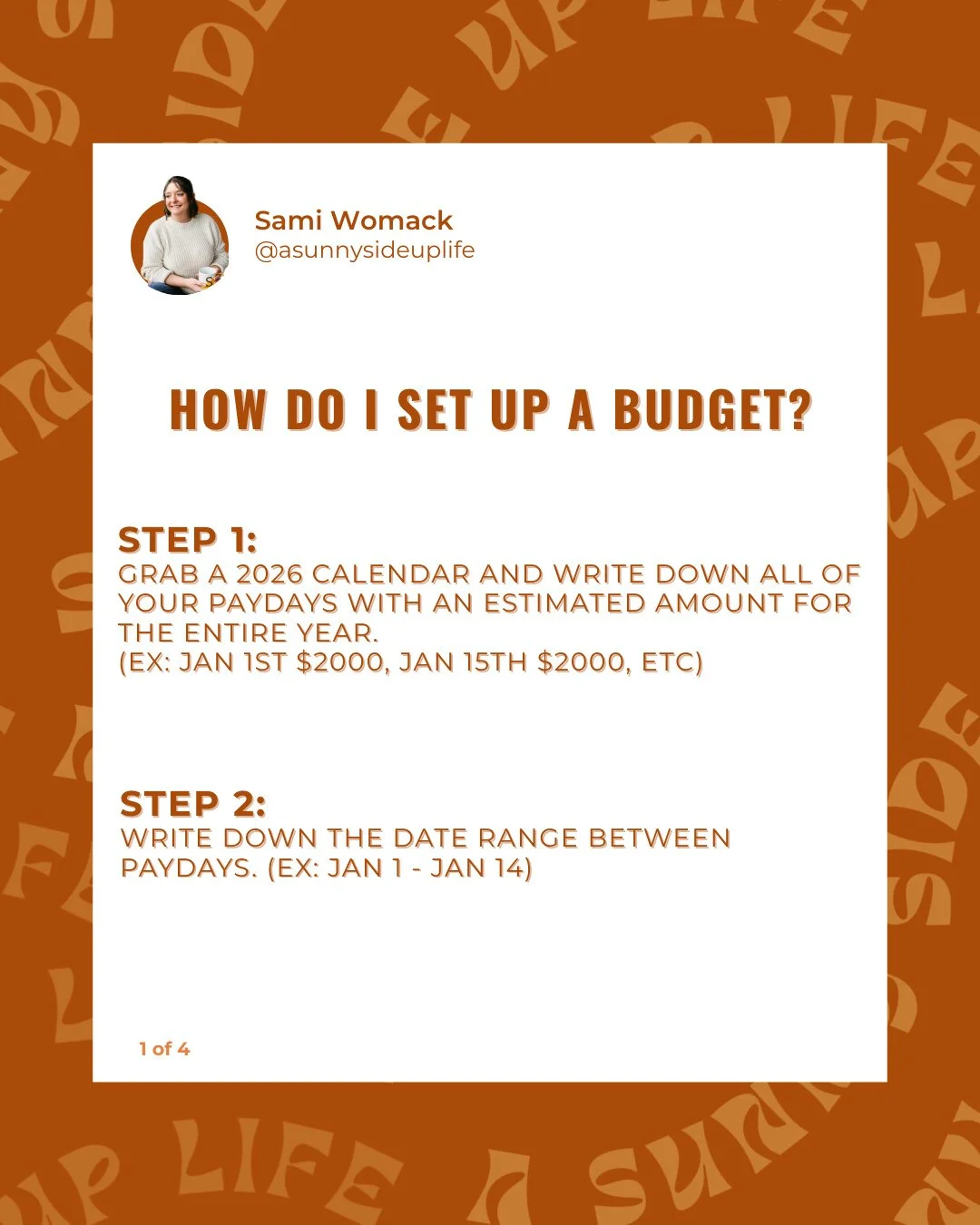

I'm the wife to my high school sweetheart, Daniel, + homeschooling momma to our 3 girls. I'm the Budgeting Coach + Motivational Speaker behind

A Sunny Side Up Life.

My family used to be in $490k of debt + living paycheck-to-paycheck, but after we hit rock bottom everything changed for us!

Now that my family has become debt free + gained financial freedom, I want to help your family do the same! My passion is inspiring women to live abundant lives through budgeting, intentional living, and positive thinking.

I offer a jump start into budgeting with my free 8-day Declutter Your Budget Challenge + full budgeting experience with my course, Your Sunny Money Method.

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

![[5 tips to survive getting out of debt when dealing with depression] blog thumbnail.png](https://images.squarespace-cdn.com/content/v1/5779e6a8be65944fd9c3ae05/1555698915635-GFYRA668K311BQLN00CU/%5B5+tips+to+survive+getting+out+of+debt+when+dealing+with+depression%5D+blog+thumbnail.png)