by Guest Author: Melody Johnson from @herdesignedlifecoach

When I first started launched my blog, business budgeting was the last thing on my mind. Website development, social media engagement, digital products, and email funnels cluttered the top of my priority list. As the tax deadline approached, I quickly realized my mistake. Over the course of a few days, I huddled up with my online bank statements, grabbed several cups of coffee, and got to work on taking charge of my business budget.

1. Separate your personal and business finances

One of the first things you need to do before you even purchase a product or service is open a separate business account. If you haven’t filed for your business license, a good starting point is to have a separate checking account for expenses. Most banks will allow you to open a business checking account with proof that your business is legitimate. Depending on the way your business is set up, you’ll need different documentation to provide to the bank.

2. Track your income and expenses

If you have a separate business checking, savings, or credit card you can more easily see your transactions. Starting out, you’ll have many costs and one easy way to see your income and expenses is to link up your separate bank account to an online budgeting software or app like Mint or YNAB. I also love using Stride to track my mileage and tax deductible expenses like coffee when meeting with a client.

3. Get paid with invoicing systems

If you are a service-based business, invoices will help you get paid. There are several invoicing systems that allow you to process one time, recurring payments, or partial payments. Personally, I love Paypal, Stripe, and Wave.

4. Don’t forget the tax man

Make sure to set aside 20-30% for taxes with each payment you receive. The easiest way to do this is to transfer money to your business savings each time you are paid. When you have a question about taxes and your business grows, consider asking for professional advice from a bookkeeper, CPA, or CFO. This money is well worth it, because a successful financial professional will find ways to help you save money in the long run

Growing your business from an exciting side hustle to a profitable business takes time and dedication. With the right tools, support, and patience, managing your business finances will help you get ahead and achieve your dreams.

Melody Johnson is a financial coach and blogger. She and her husband live in Detroit, where she helps young women reach their financial goals. In 2018, Melody paid off over $72,500 in student loans and personal debt. Her next big goal is to pay for her international adoption from the Philippines and graduate with her Master’s Degree debt free.

Feel free to follow her for more inspiring quotes and side hustle recommendations on her Instagram @herdesignedlifecoach. You can also download her quick business budget starter template for free.

Instagram: herdesignedlifecoach

Youtube : http://bit.ly/2Q6SXFi

Website: www.herdesignedlife.com

If you'd like to read this blog later, please save it to Pinterest.

Listen to the Podcast...

READY TO GAIN FINANCIAL FREEDOM

+ BREAK FREE FROM SURVIVAL MODE?

I'VE GOT EVERYTHING YOU NEED!

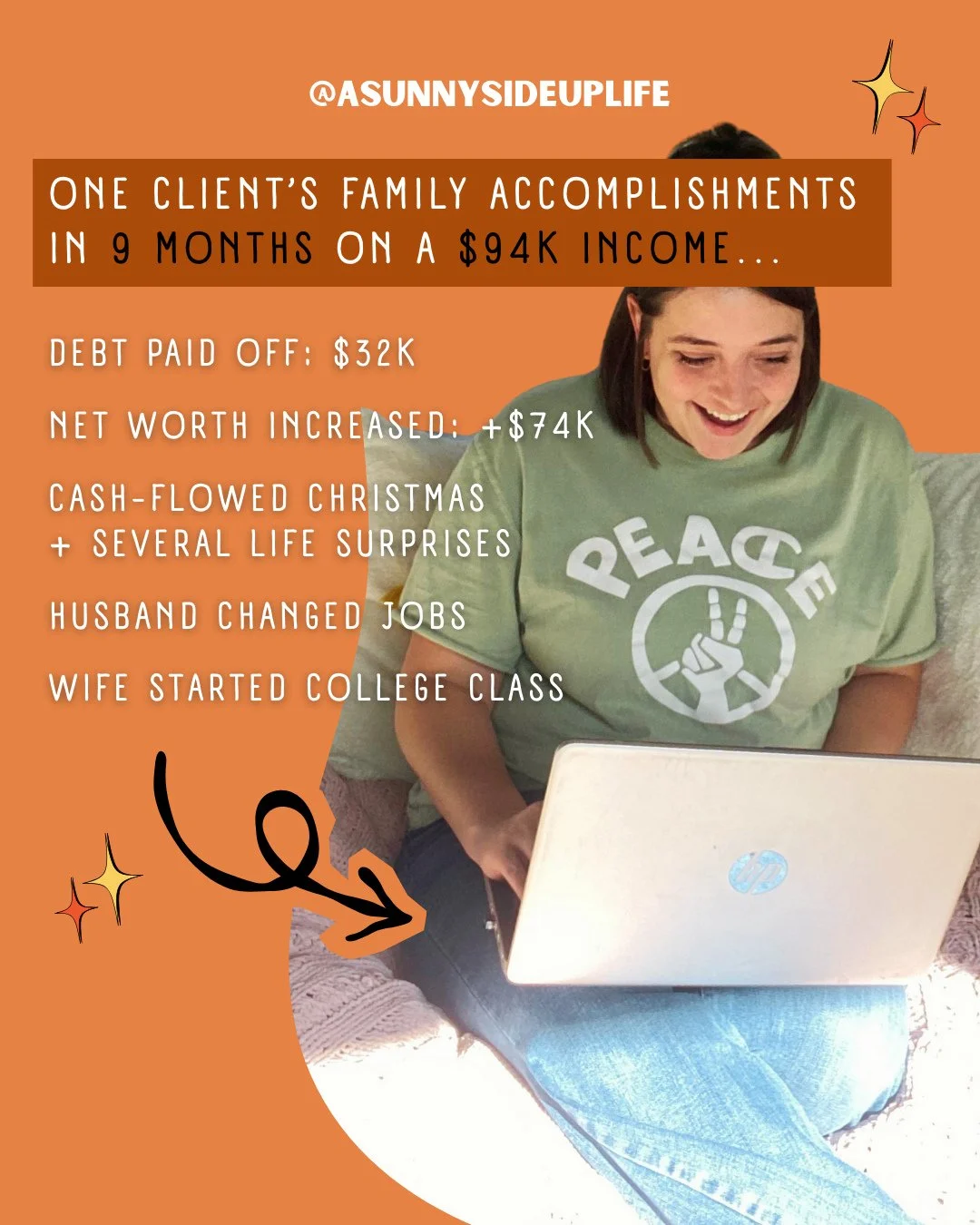

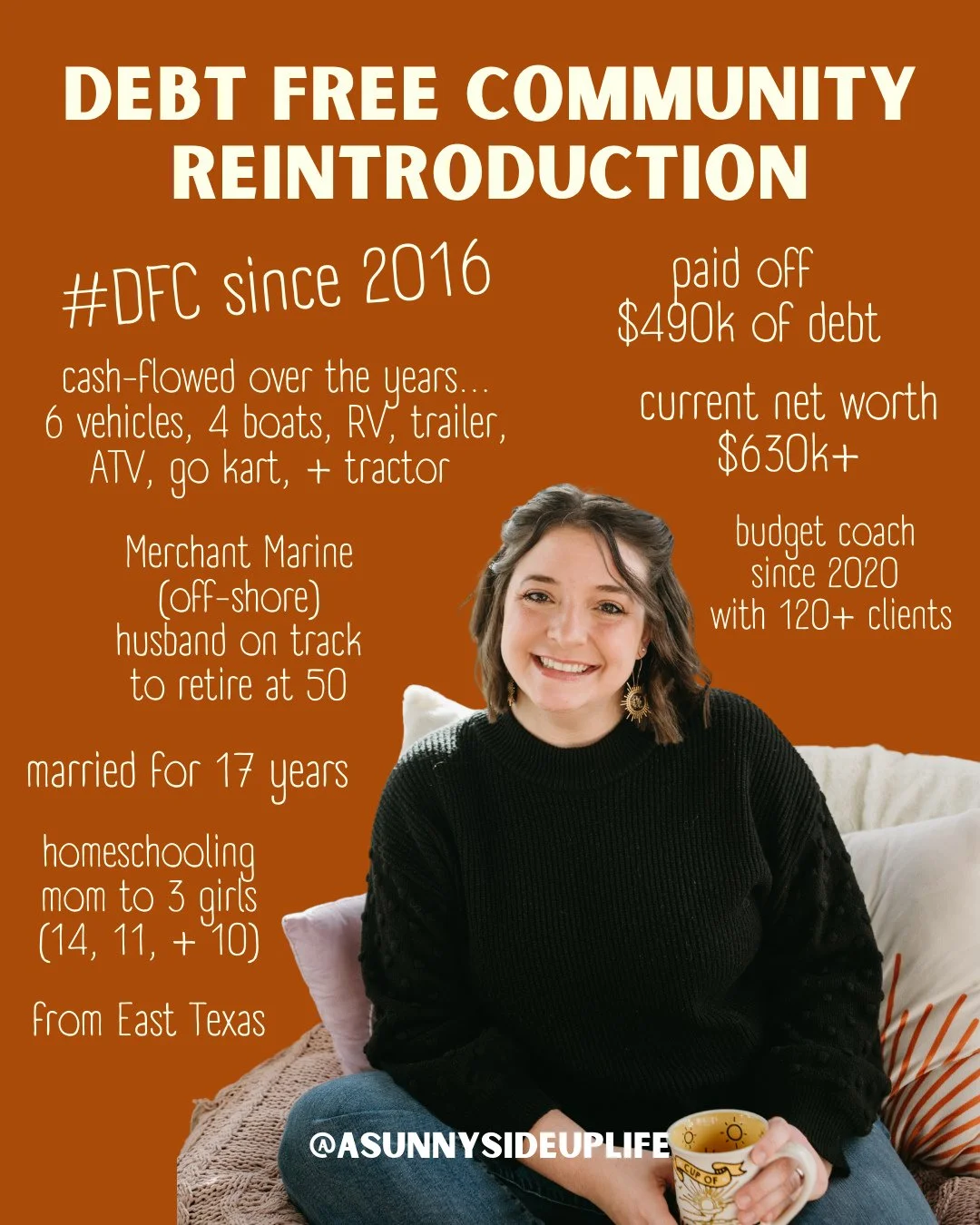

HEY I'M SAMI WOMACK

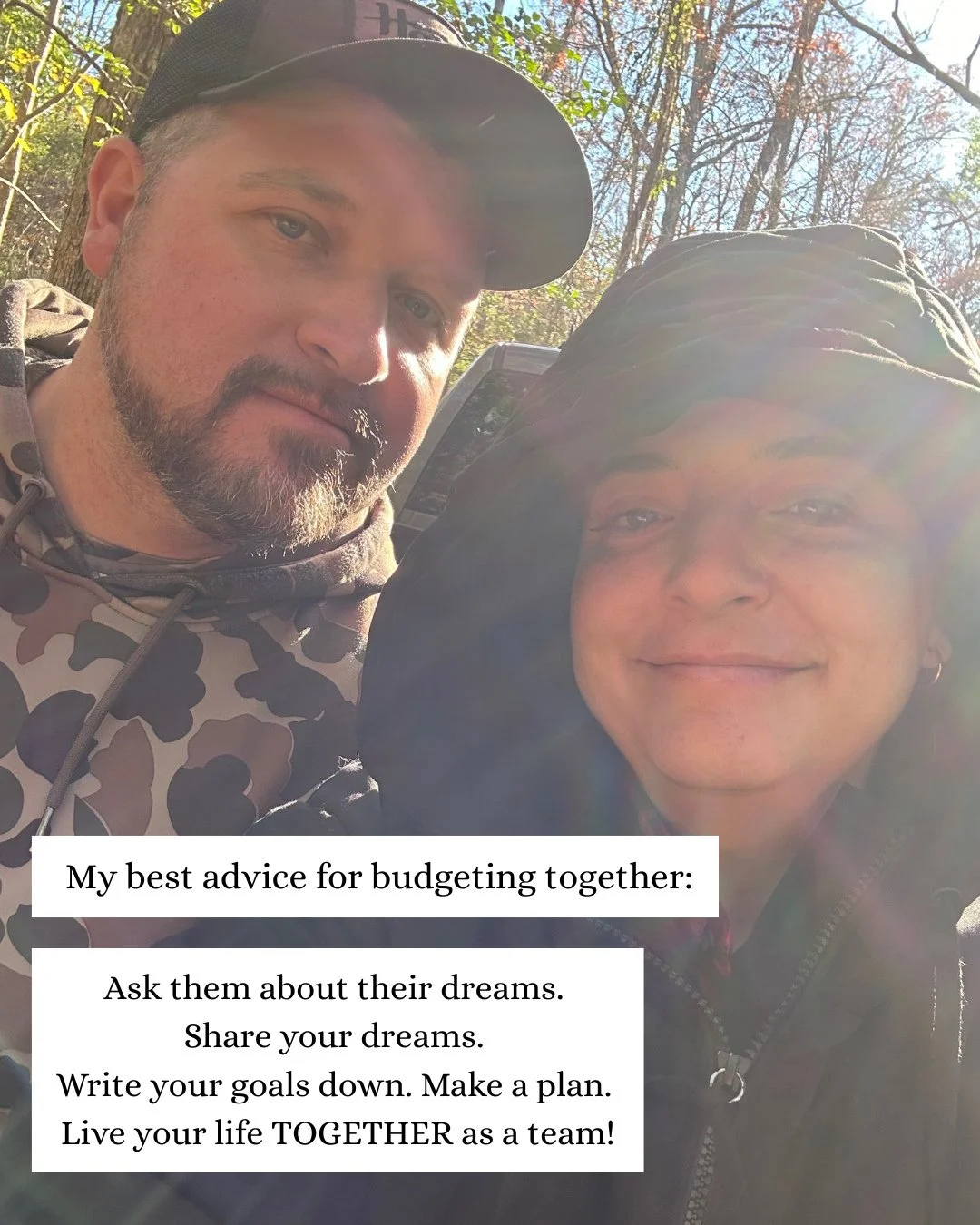

I'm the wife to my high school sweetheart, Daniel, + homeschooling momma to our 3 girls. I'm the Budgeting Coach + Motivational Speaker behind

A Sunny Side Up Life.

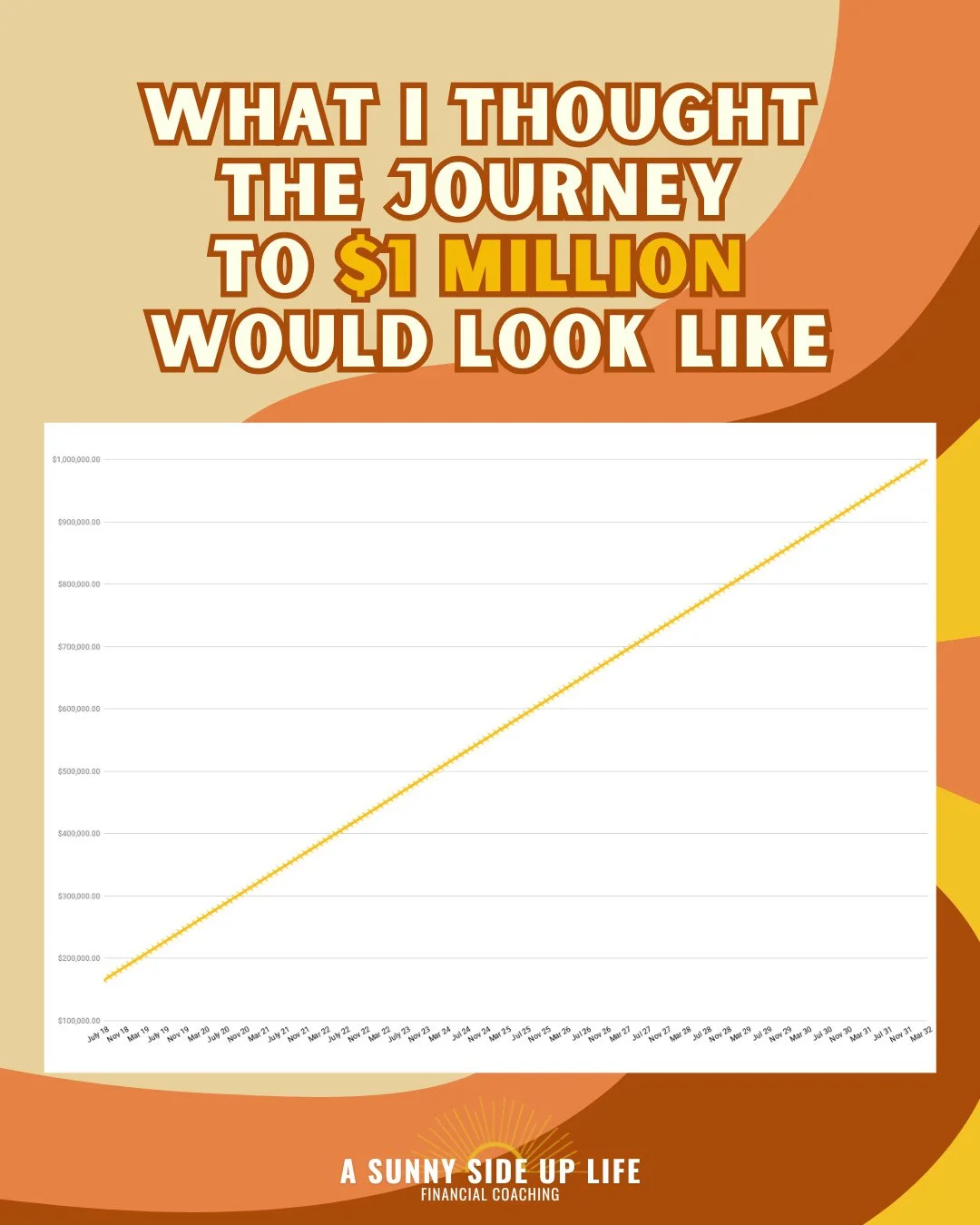

My family used to be in $490k of debt + living paycheck-to-paycheck, but after we hit rock bottom everything changed for us!

Now that my family has become debt free + gained financial freedom, I want to help your family do the same! My passion is inspiring women to live abundant lives through budgeting, intentional living, and positive thinking.

I offer a jump start into budgeting with my free 8-day Declutter Your Budget Challenge + full budgeting experience with my course, Your Sunny Money Method.

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

![[title] blog thumbnail-2.jpeg](https://images.squarespace-cdn.com/content/v1/5779e6a8be65944fd9c3ae05/1560906507961-EX8SQ3A5LRQ3AGW029S6/%5Btitle%5D+blog+thumbnail-2.jpeg)