This post may contain affiliate links. Visit my disclaimer page for more info.

Starting your debt-free journey can be a bit overwhelming, so I wanted to keep it super simple for you! I’ve gathered a list of my 7 must have tools that will guarantee success during your first month (and beyond) of budgeting.

1. budgeting worksheets

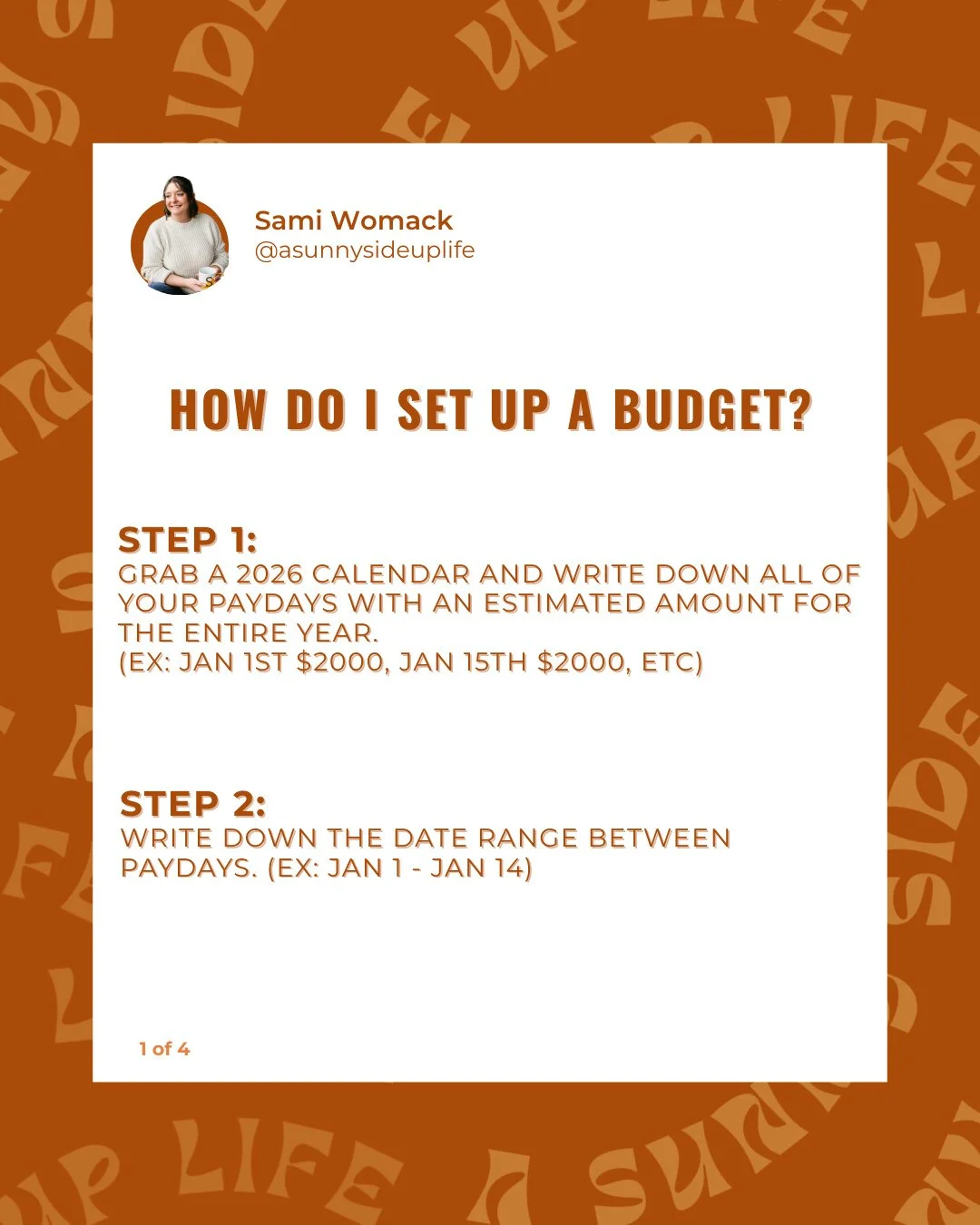

Worksheets might seem like a given, but they HAVE to be mentioned first and foremost before we talk about anything else! You have to have a written budget…not something made up in your head, not something you’ve scribbled on your lunch napkin while you wonder if your debit card is about to get declined, I’m talking about a legit written budget!

This can be handwritten on notebook paper, handwritten on printed out worksheets, typed in an Excel file you made yourself, typed in a Google Sheets template you found online, inputted into an app…any of the above will get you organized.

Whichever medium you decide to use, just promise me that you’ll make an intentional plan for how your money is going to be spent and that you’ll check in with it before, during, and after payday.

>> Check out the set of Budgeting Worksheets that my family uses

2. debt calculator

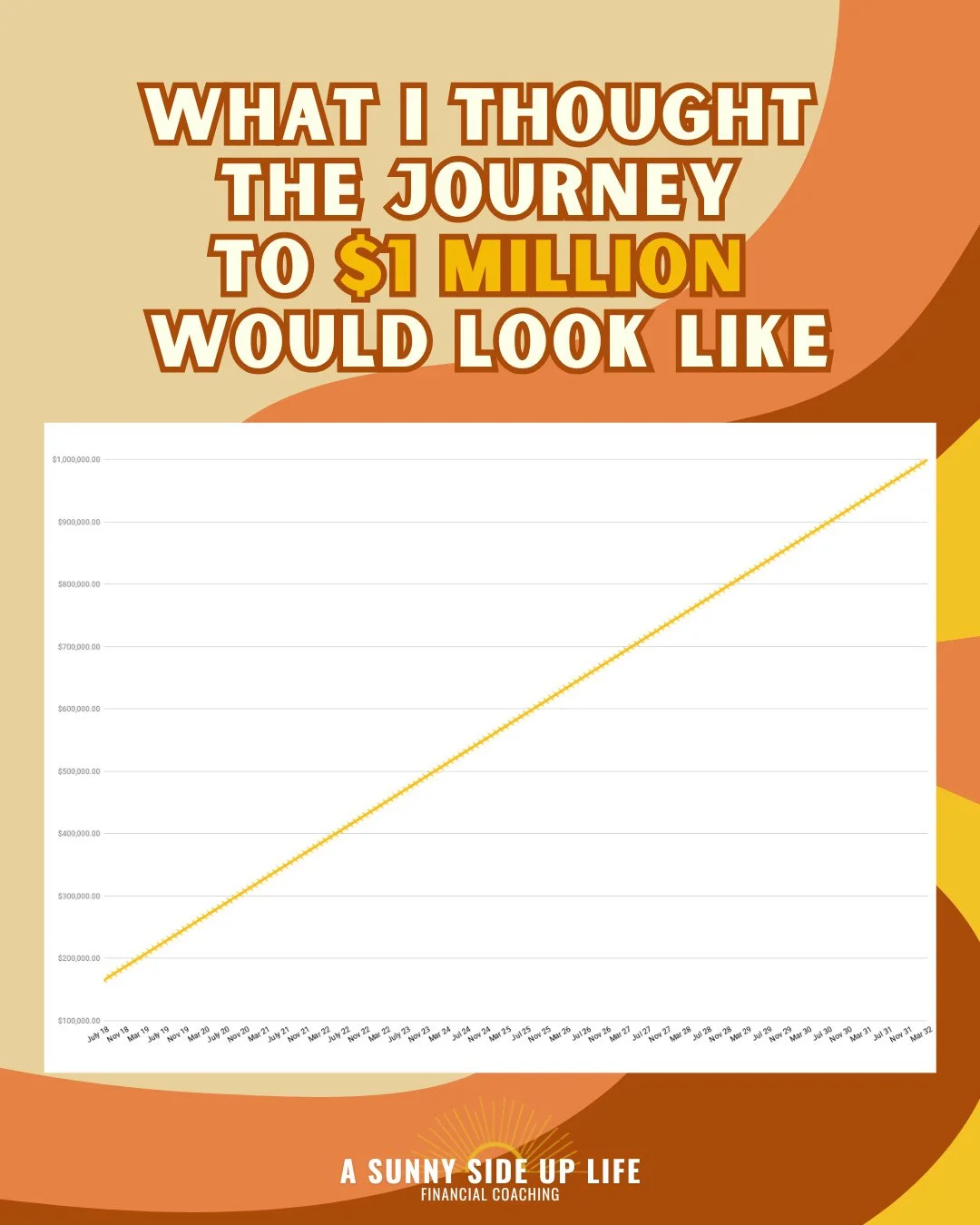

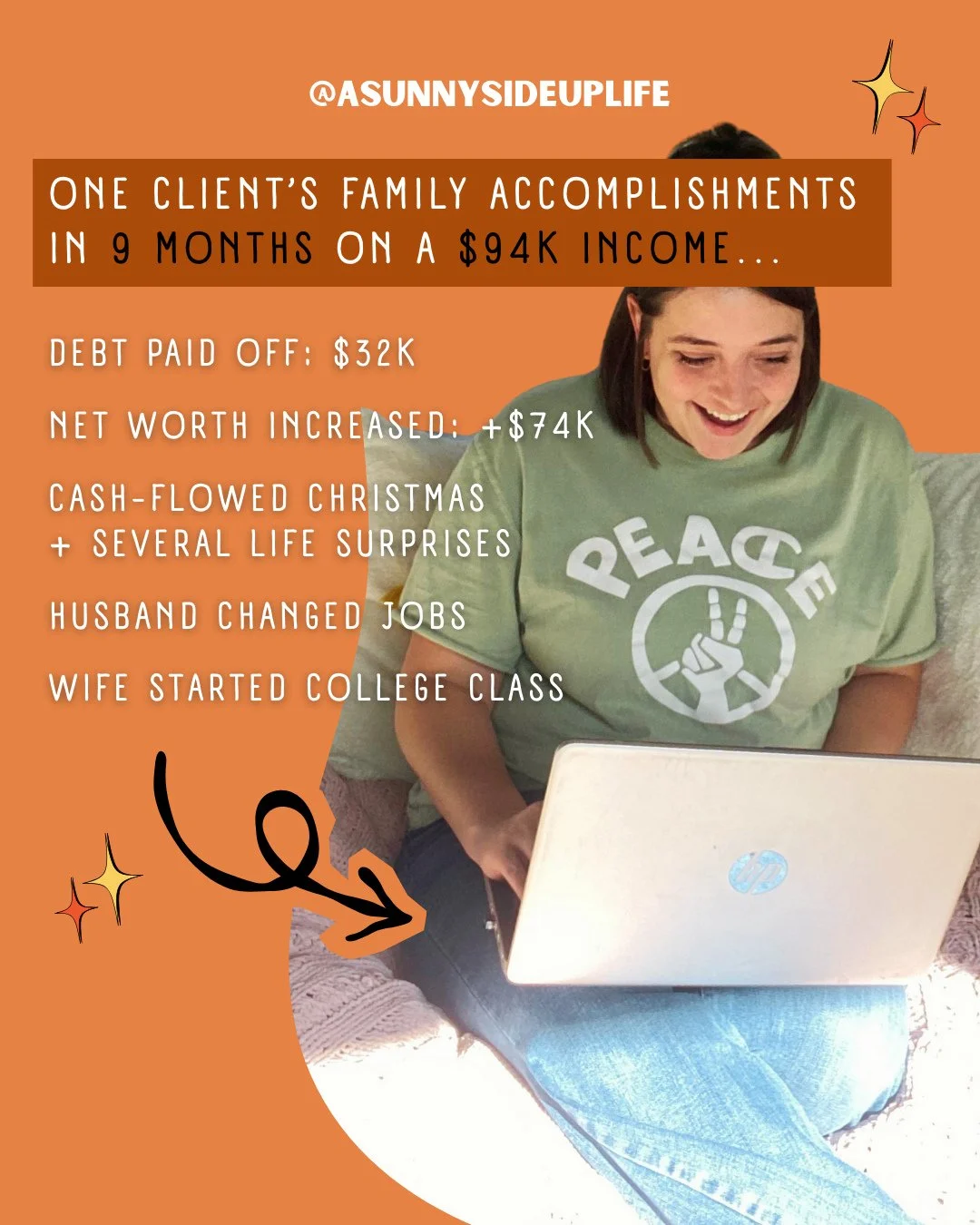

You have to know where you stand with your debt totals, payoff dates, and how much you could speed up your timeline if you made extra payments. Knowledge is power my friend! It’s scary to know that total…especially if it’s $490k like mine was…but the sooner you know your numbers, the sooner you can start to knock it out.

Adding Easy Budget’s Debt Snowball Calculator to your budgeting tool box is second on my list for a reason…it’s an amazing resource! All have to do is plug your numbers in and everything else is done for you automatically. It will clearly display your debt payoff month and year, it’ll allow you to input one-time lump sum payments on debt (bonuses, tax refunds, etc), and you can change and play around with several variables to see how it’ll affect your payoff date. Super simple + user friendly!

>> Check out the Debt Snowball Calculator for yourself

3. visual motivation

What if I told you that this entire journey didn’t have to be black-and-white, boring-boring-boring!?! Would you be more likely to make it past the first month, second month, or even several years?

Looking at vision boards, motivational quotes, or printing out a Debt Free Chart for each goal, is the best way to stay motivated during the day-to-day of paying off debt.

Ellie Mondelli says, “Surrounding myself with visual aids has helped me tremendously to stay motivated. In addition to serving as reminders of my goals and the positive mindset I need to keep, I always look forward to updating my charts every two weeks.” Read Ellie’s 5 Ways To Use Visual Aids To Stay Motivated

4. meal plan

Food will be one the biggest parts of your budget…like it or not, you’ve gotta eat…even while you’re paying off debt! The best way to make sure that you’re not spending more money than necessary on your groceries is to be intentional with each meal by making a meal plan. No more wasting leftovers, forgetting to buy ingredients, or feeling too overwhelmed to cook and finding yourself face-to-face with the pizza delivery guy for the second time this week.

Meal planning is a learned skill, and if you're a newbie and this all seems like A LOT to take in, then I'd highly recommend Let's Make Meal Planning Simple. I love this step-by-step guide that my friend Christine from The Mostly Simple Life created. It's full of expert tips, full pre-made meal plans, + all of the worksheets you need! This is what I used to build my meal planning muscle!

5. community of like-minded people

The beginning of your journey can be super lonely. You might not have a lot of people in your immediate circle, like your friends, your family, or your co-workers, who understand and support what you’re doing. However, there are thousands of virtual-friends just waiting to cheer you on in places like The Debt Free Community on Instagram + A Sunny Side Up Life Community on Facebook, just to name a few. Search hashtags, join private Facebook Groups, get involved in a local #debtfreecommunity meetup, or start your own community, club, or group.

6. positive podcasts

Each day you’ve got to find things that will keep your head in the game. Filling your earbuds with daily doses of positivity will prevent you from getting off course…especially in the beginning of your journey. There’s an endless supply of podcasts online for free just waiting for you to subscribe to them!

>> Find 50+ Podcast Recommendations from the community

7. motivational books

You’ve got to keep growing + learning. This debt-free journey isn’t a sprint, it’s a marathon. You have to be in this for the long haul. Those who have made it to the other side did it because they simply didn’t quit. They worked on their personal development, grew as a person, and adopted this journey as a lasting way of life!

>> Check out 5 Books That Will Help You Step Out Of Your Comfort Zone

If you'd like to read this blog later, please save it to Pinterest.

Listen to every episode...

READY TO GAIN FINANCIAL FREEDOM

+ BREAK FREE FROM SURVIVAL MODE?

I'VE GOT EVERYTHING YOU NEED!

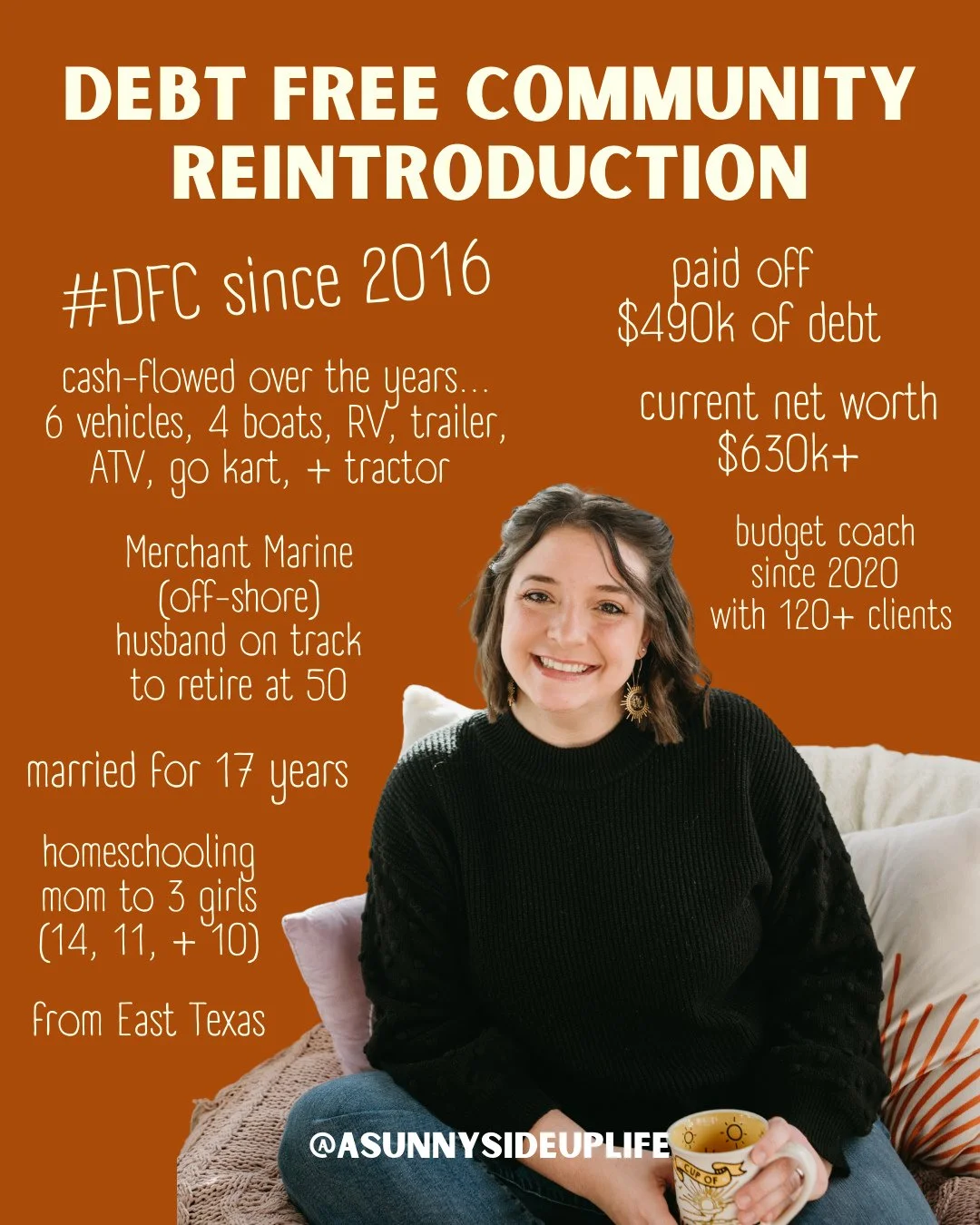

HEY I'M SAMI WOMACK

I'm the wife to my high school sweetheart, Daniel, + homeschooling momma to our 3 girls. I'm the Budgeting Coach + Motivational Speaker behind

A Sunny Side Up Life.

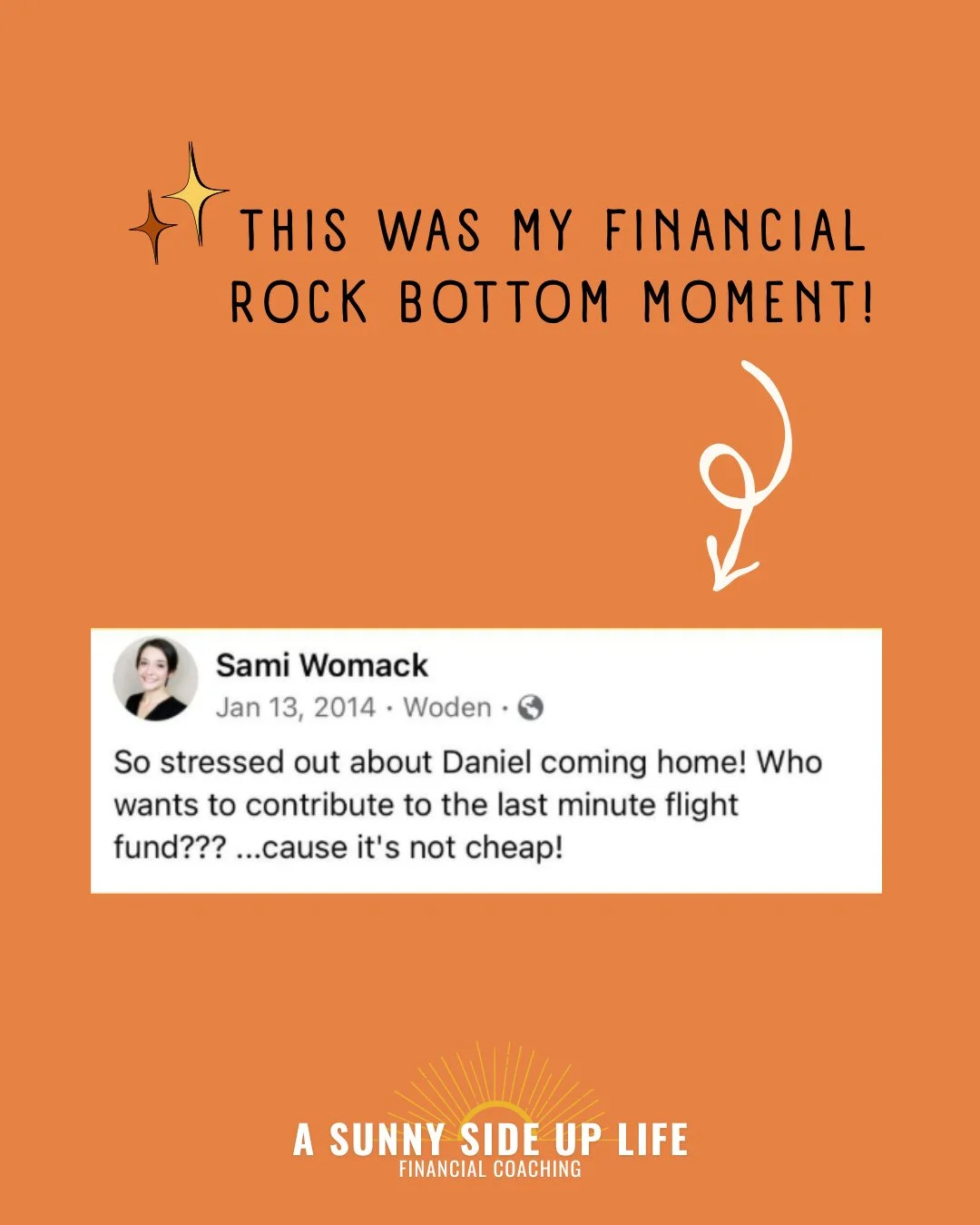

My family used to be in $490k of debt + living paycheck-to-paycheck, but after we hit rock bottom everything changed for us!

Now that my family has become debt free + gained financial freedom, I want to help your family do the same! My passion is inspiring women to live abundant lives through budgeting, intentional living, and positive thinking.

I offer a jump start into budgeting with my free 8-day Declutter Your Budget Challenge + full budgeting experience with my course, Your Sunny Money Method.

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

Disclosure: There are some affiliate links above, but these are all products I highly recommend. I won’t put anything on this page that I haven’t verified and/or personally used. Read our disclaimer here.

![[7 much have tools for your first month of budgeting] thumbnail.png](https://images.squarespace-cdn.com/content/v1/5779e6a8be65944fd9c3ae05/1554336168161-8TCC1ISK7CGMQE9V4L0I/%5B7+much+have+tools+for+your+first+month+of+budgeting%5D+thumbnail.png)