This post may contain affiliate links. Visit my disclaimer page for more info.

Lexa VanDamme, queer personal finance coach and creator of The Avocado Toast Budget, joins the podcast to discuss her mission: to teach people how to save, pay off debt, invest, and finally feel confident with money.

We discuss her entrepreneurial journey, why she thinks Dave Ramsey is old news, and how to succeed with money when living with a mental health disorder.

Lexa has been featured on Business Insider, Time, + CNBC and has a social media following of over 500k.

In this episode, Sami + Lexa chat about:

How shame and guilt shapes our perception of finance

The power of empathy and grace when it comes to spending habits

Step-by-step actions to take if you’re overspending OR a new budgeted

Navigating mental health and money with the magic of automation

3 issues Lexa has with Dave Ramsey + his stagnant Baby Step Program

The slippery slope of “real” numbers + more

SPONSOR(S):

Price Of Avocado Toast Podcast: Listen and subscribe to the Price of Avocado Toast Podcast TODAY!

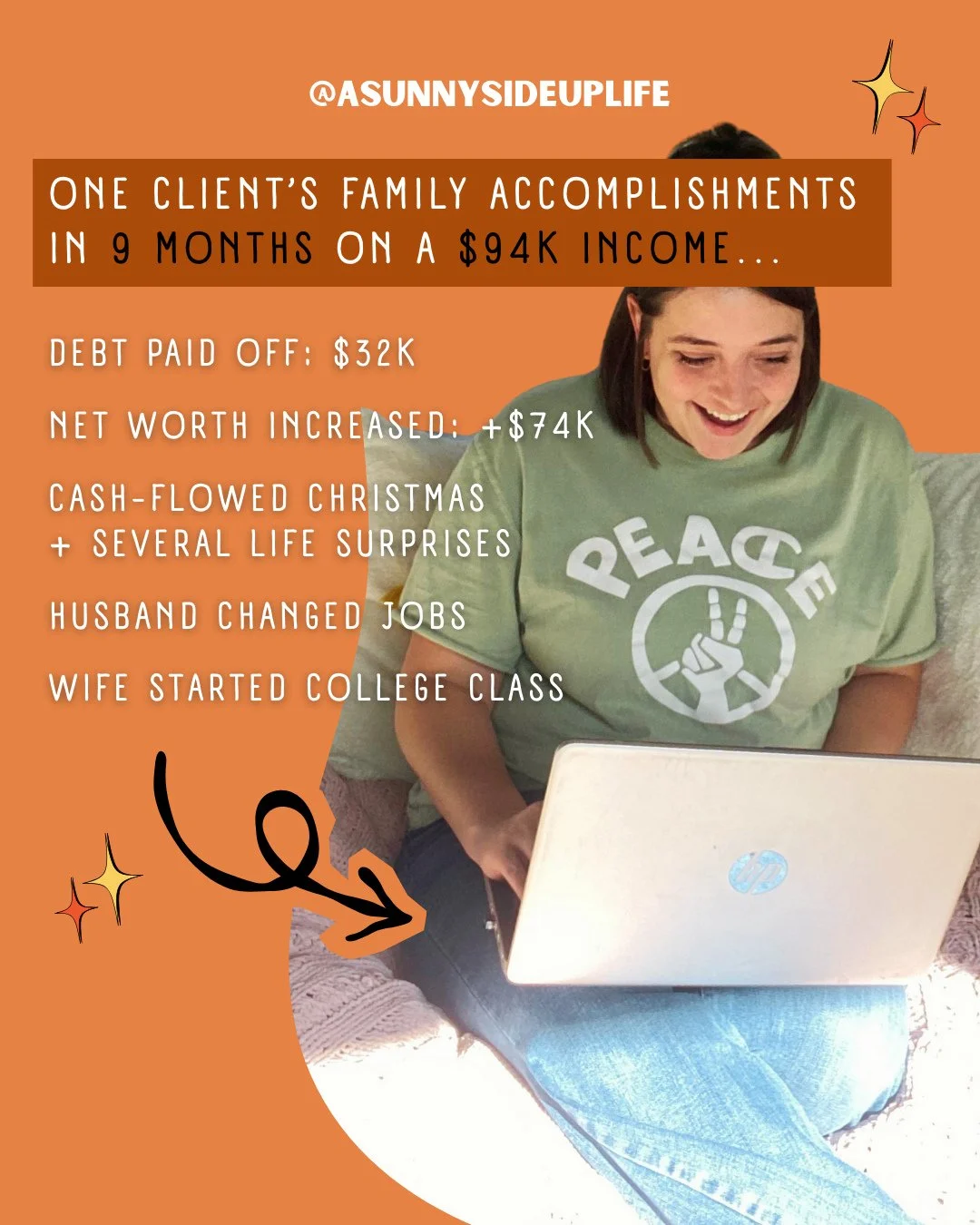

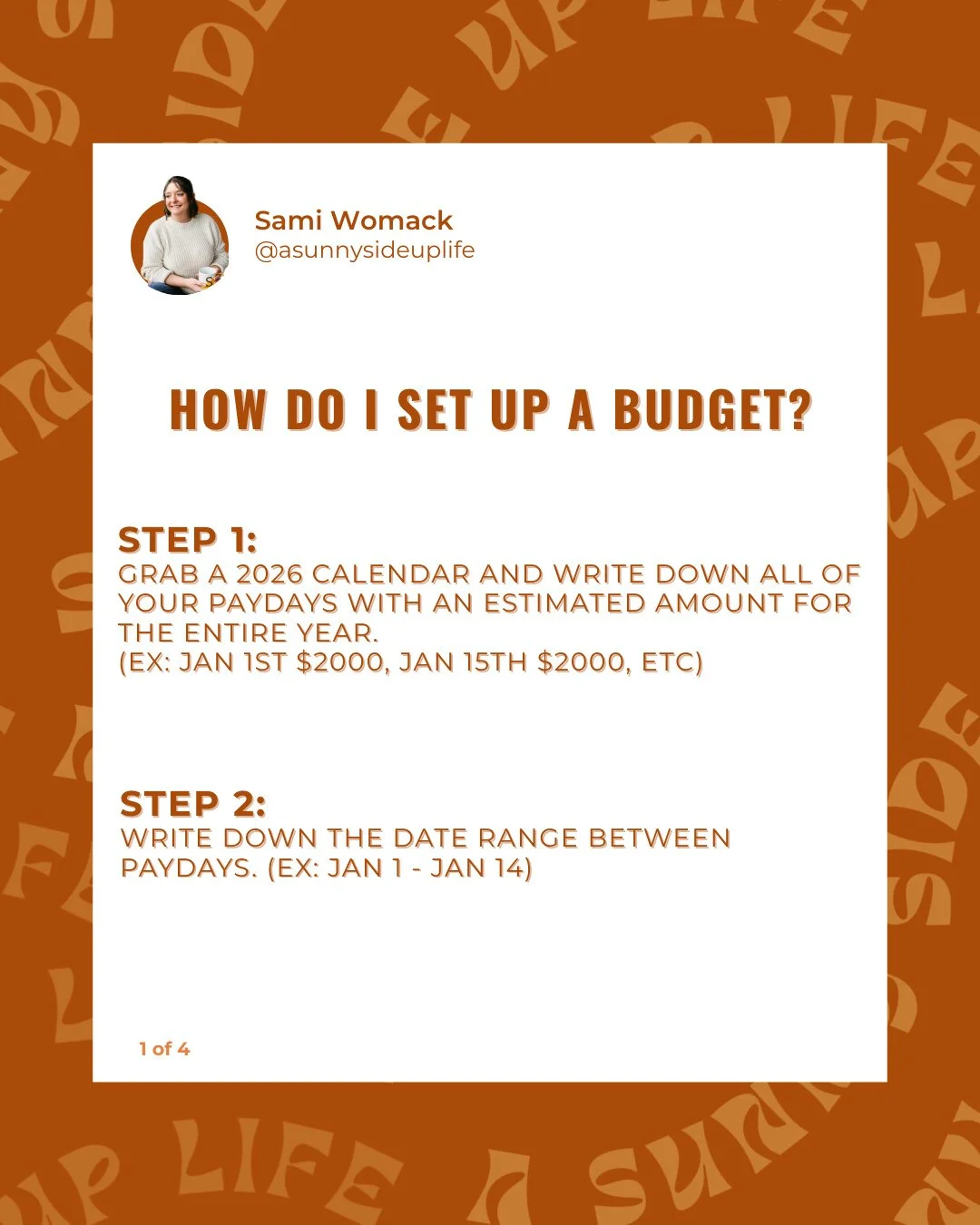

1:1 Budget Coaching: 1:1 Coaching Sessions are for 12 weeks of fully personalized support. Together we’ll organize your bills, spending, debt, and savings goals. I’ll help you get a system in place that will set you up for success for years to come. I’ll be there to hold you accountable, talk you through building new habits, and help you adopt a positive mindset towards your life!

MENTIONED IN THE EPISODE:

ASSUL RESOURCES:

1:1 Coaching With Sami: Apply today

YouTube: Subscribe for free

Instagram: Follow me on the ‘gram

Facebook: Follow me on Facebook

The Sunny Squad: Join the VIP Facebook Group

GUEST BIO: LEXA VANDAMME

Lexa VanDamme is a queer-identifying personal finance coach and creator of The Avocado Toast Budget. She joins the podcast to discuss her mission: to teach people how to save, pay off debt, invest, and finally feel confident with money.

Lexa has been featured on Business Insider, Time, + CNBC and has a social media following of over 500k.

GUEST SOCIAL + WEBSITE:

SHOW INFORMATION: A Sunny Side Up Life

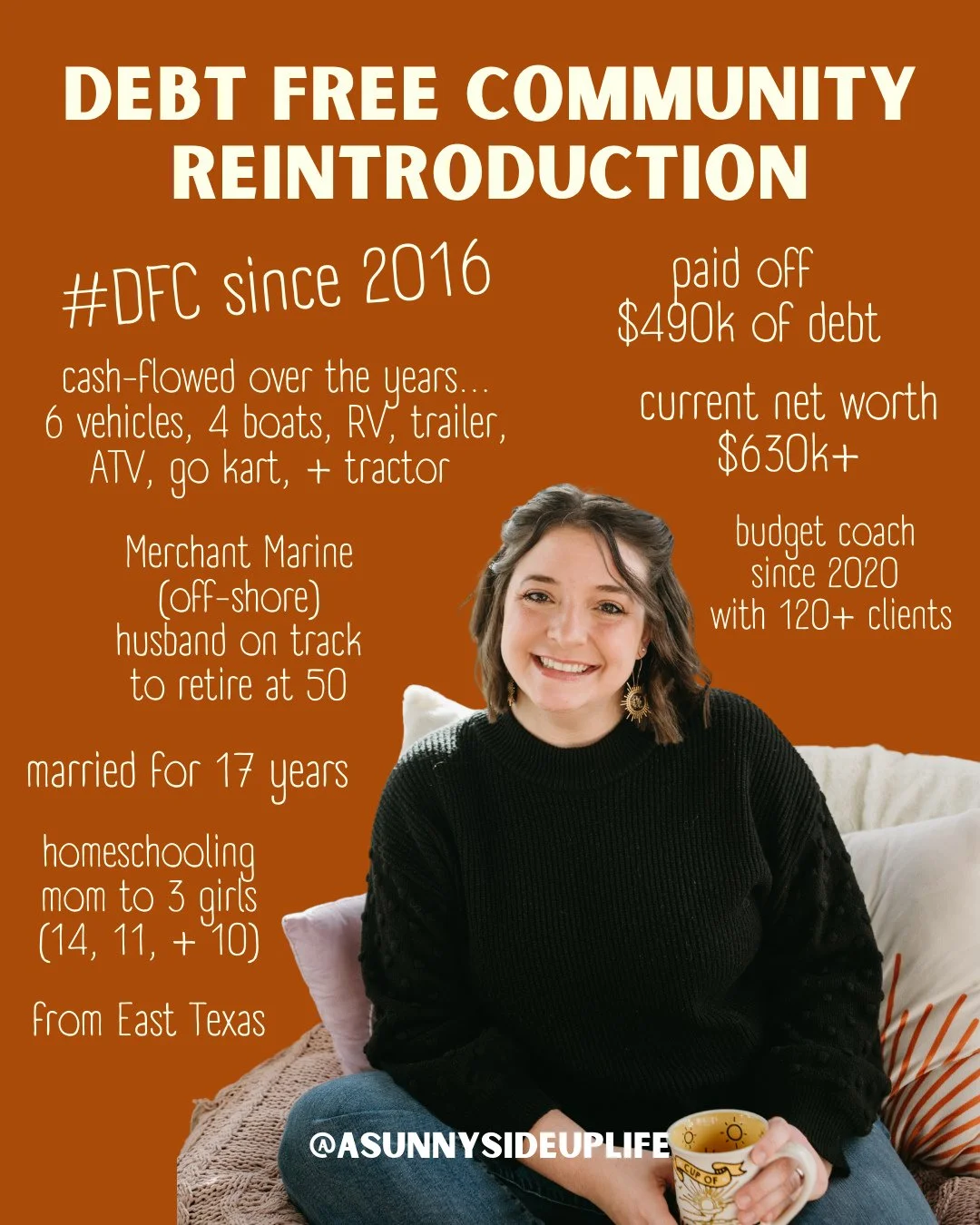

A Sunny Side Up Life Podcast is a show for women who are ready to live an abundant life full of freedom + positivity. Sami Womack, nationally recognized money expert and finance coach guides listeners toward breaking free from survival mode, gaining financial freedom, staying motivated, and focusing on what matters most.

Listen to every episode...

what kind of support do you need?

WHO IS YOUR PODCAST HOST?

Sami Womack is the brains behind A Sunny Side Up Life. Her weekly podcast has been downloaded over 250,000 times, and her story has been featured on YNAB, Debt.com, The Purpose Show with Allie Casazza, and The His & Her Money Show. When she’s not downing caramel coffee or homeschooling her daughters, she’s creating content, collaborating with finance/minimalist organizations, and inspiring women all over the world to live an intentional life.

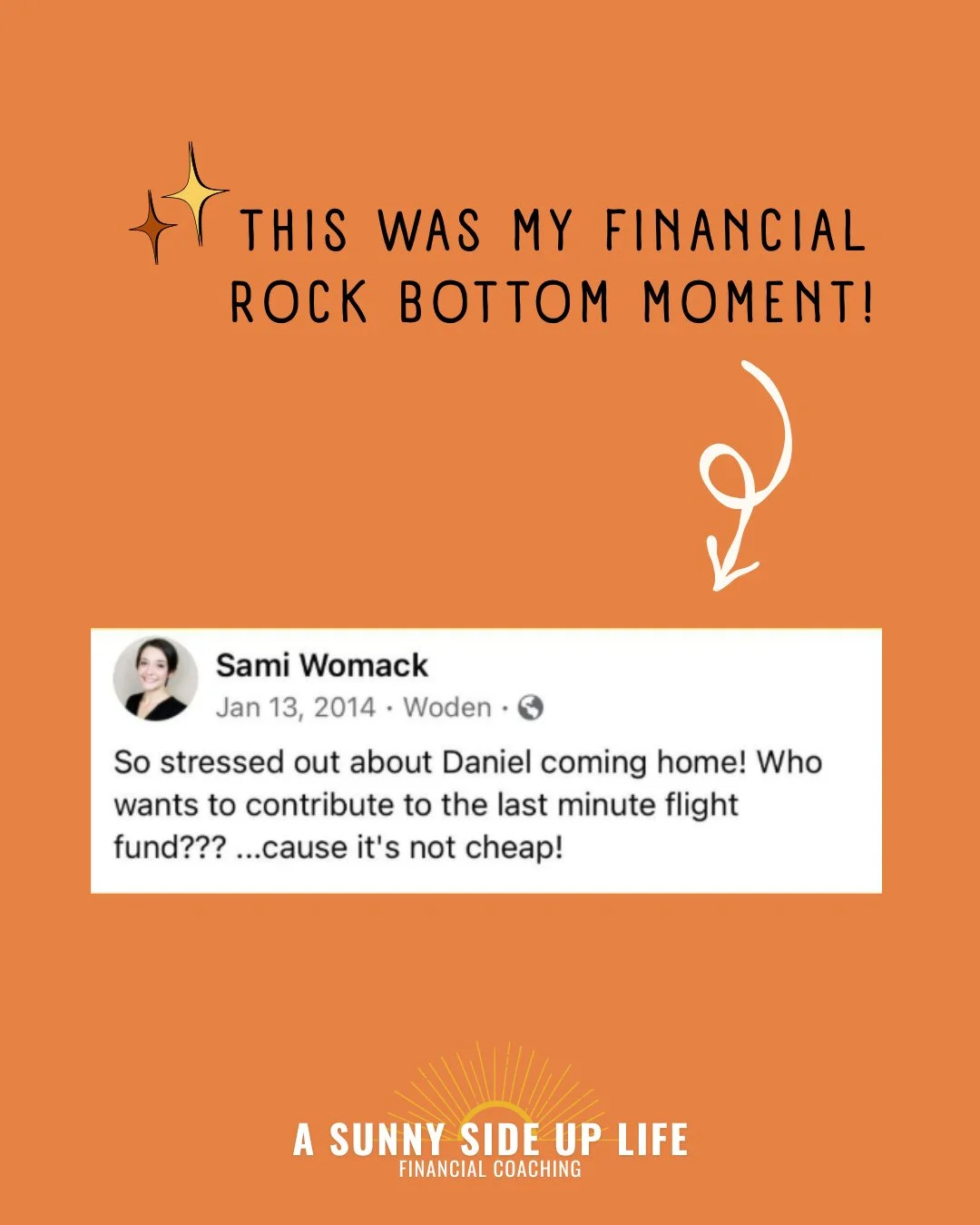

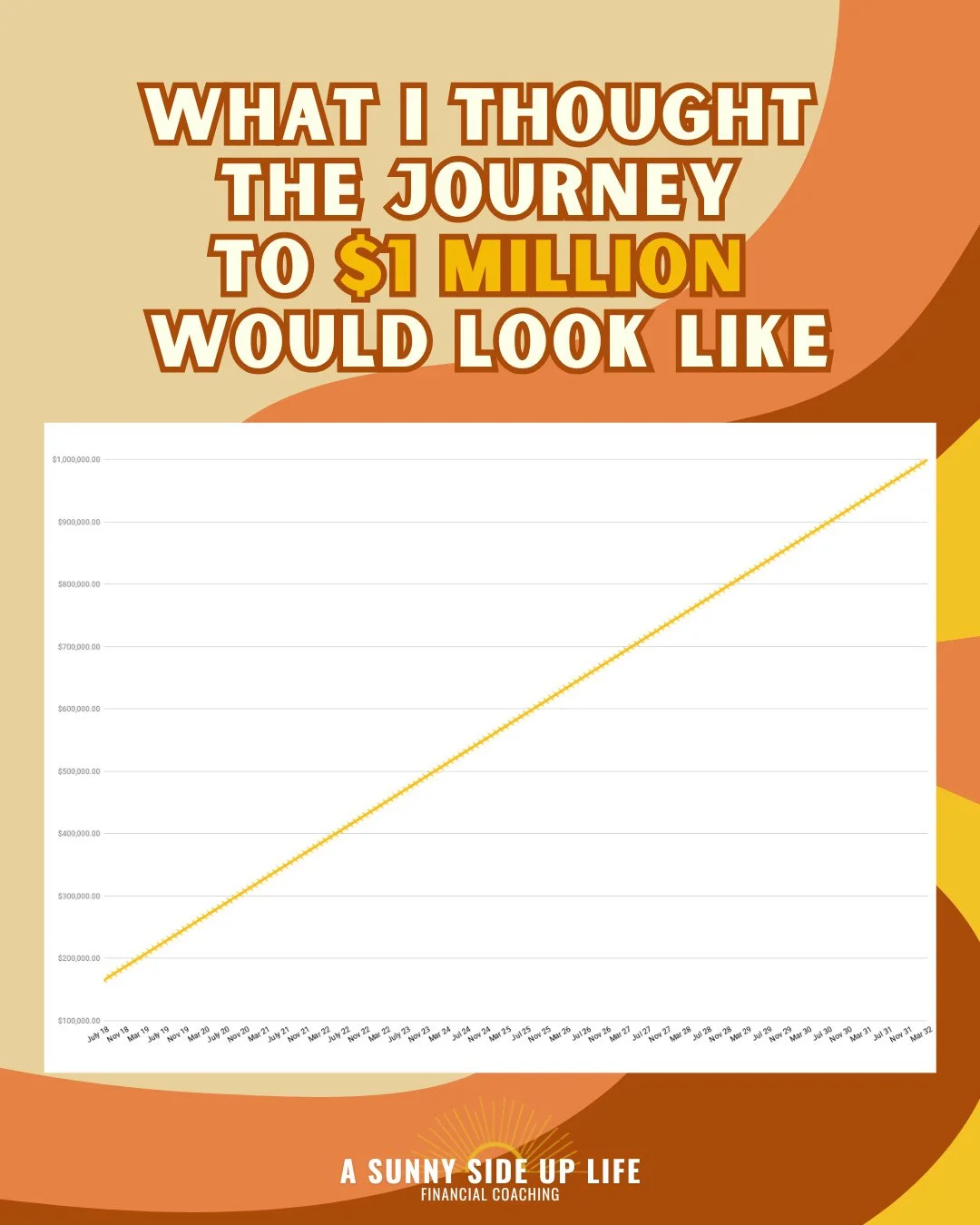

She began this journey with her high school sweetheart, Daniel, and a debt price tag of $490,000. They both took control of their family’s finances by downsizing, budgeting, and changing habits. From this experience, A Sunny Side Up Life was born.

Today, Sami owns this business helping women get through dark times and experience the life-altering magic of intentional living.

She offers a jump start into budgeting a FREE 5-Day Challenge + a personalized experience with 1:1 Budget Coaching.

Follow Me For More Money Inspo

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

Disclaimers: This show may contain affiliate links or links from our advertisers where we earn a commission or direct payment.

Opinions are the creators alone. Information shared on this podcast is for entertainment purposes only and should not be considered as professional advice. Read our full affiliate disclaimer here.